indiana employer payroll tax calculator

All Services Backed by Tax Guarantee. Indiana Salary Tax Calculator for the Tax Year 202122.

Paycheck Calculator Take Home Pay Calculator

Free Unbiased Reviews Top Picks.

. How to File Your Payroll Taxes. These are state and county taxes that are. Discover ADP Payroll Benefits Insurance Time Talent HR More.

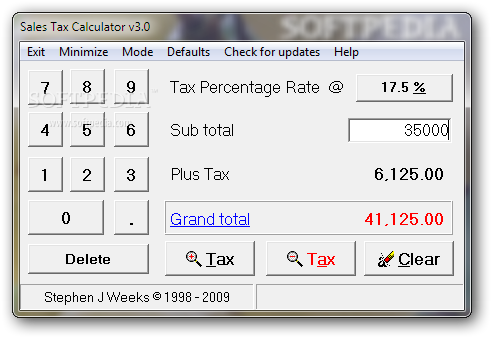

It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income.

EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Choose Marital Status Single or Dual Income Married Married one income Head of Household.

Just enter the wages tax withholdings and other information required. The aggregate of Indian state income tax and local tax applicable in a. Get Started With ADP Payroll.

Free paycheck calculator for both hourly and salary employees. Ad Compare Side-by-Side the Best Payroll Service for Your Business. Ad Process Payroll Faster Easier With ADP Payroll.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Payments must be made not more than 10 days following the close of a. Indiana SUI Rates range from 050 to 94 for 2021.

Calculate your Indiana self-employment 1099 taxes for free with this online calculator from Bonsai. Number of Qualifying Children under Age 17. Calculate accurate take home pay using current Federal and State withholding rates.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Indiana residents only. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Indiana State Unemployment Insurance SUI Indiana Wage Base 9500 for 2021.

The standard FUTA tax rate is 6 so your max. Our calculator has recently. The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Indiana State.

Employers covered by Indianas wage payment law must pay wages at least semimonthly or biweekly if requested. Ad Compare This Years Top 5 Free Payroll Software. As allowed by Senate Enrolled Act 549 this rate pertains to all PERF employers for 2022 and 2023.

The Indiana inheritance tax was repealed as of December 31 2012. How much is the. Calculating your Indiana state income tax is.

Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. ATTENTION-- ALL businesses in Indiana must file and pay.

PERF My Choice Plan The breakdown of the PERF 2022 contribution rate for state of. So the tax year 2021 will start from July 01 2020 to June 30 2021. Indiana tax year starts from July 01 the year before to June 30 the current year.

Updated for the 2020 - 2021 tax season. As an employer you must match this tax dollar-for. Focus on Your Business.

Make Your Payroll Effortless So You Can Save Time Money. Get Started With ADP Payroll. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year.

County Rates Available Online-- Indiana county resident and nonresident income tax rates are available via Department Notice 1. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or. You can actually lower.

If you have employees working at your business youll need to collect withholding taxes. What does eSmart Paychecks FREE Payroll Calculator do. Indiana allows employers to credit up to 512 in earned tips against an employees wages per hour which can result in a cash wage as low as 213 per hour.

The IRS has changed the withholding rules. For individuals who die after that date no inheritance tax is due on payments from their estate. How You Can Affect Your Indiana Paycheck.

Indiana Hourly Paycheck Calculator. Check if you have multiple jobs. Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

It is not a substitute for the advice of. SmartAssets Indiana paycheck calculator shows your hourly and salary income after federal state and local taxes. Prepare your FICA taxes Medicare and Social Security monthly or semi.

You are able to use our Indiana State Tax Calculator to calculate your total tax costs in the tax year 202122. Ad Payroll So Easy You Can Set It Up Run It Yourself. Withhold 62 of each employees taxable wages until they earn gross pay.

Get Started for Free.

Payroll Tax What It Is How To Calculate It Bench Accounting

Llc Tax Calculator Definitive Small Business Tax Estimator

How To Calculate Payroll Taxes Methods Examples More

Tax Calculator For Items Clearance 54 Off Www Ingeniovirtual Com

Ohio Sales Tax Calculator Reverse Sales Dremployee

Free Payroll Tax Calculator Paycheck Calculation Fingercheck

Paycheck Calculator Take Home Pay Calculator

Indiana Paycheck Calculator Smartasset

Income Tax Calculator 2021 2022 Estimate Return Refund

Online Tax Withholding Calculator 2021

How To Calculate Indiana Income Tax Withholdings

Employer Payroll Tax Calculator Incfile Com

Income Tax Calculator Estimate Your Refund In Seconds For Free

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

![]()

Indiana Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Indiana Paycheck Calculator Adp

Easiest 2021 Fica Tax Calculator

Tax Calculator For Items Clearance 54 Off Www Ingeniovirtual Com